Passive Income V/S Active Income

Understanding the Key Differences Introduction:

Exploring the World of Income Generation in

the present high speed world, there is a rising longing to accomplish monetary

security and autonomy. To achieve these objectives, figuring out the two

essential sorts of pay:

recurring, automated revenue and dynamic income is

fundamental.

Both avenues offer unique benefits

and challenges.

Passive Income: Embracing the Art of Earning While You Sleep

What is passive income?

Passive income refers to the money you earn with minimal ongoing effort or

direct involvement. This type of income stream often requires an initial investment of time, money, or resources

to set up, after which it can generate regular income without continuous active

participation.

Examples of passive income:

Investment properties: Claiming and leasing land properties can give a constant flow of recurring, automated revenue through month to month lease installments.

Profit paying stocks:Putting

resources into portions of organizations that disseminate a part of their

benefits as profits permits you to procure recurring, automated revenue. Eminences:On the off chance that you make licensed innovation like

books, music, or licenses, you can get progressing sovereignties from its use.

Going about as a bank through web-based stages

can empower you to procure revenue on credits made to other people.

Advantages of passive income:

Flexibility: Passive income allows you the freedom to pursue other ventures, travel, or spend time with loved ones while still earning money.

Scalability: Once

set up, passive income streams have the potential to grow and generate

increasing amounts of revenue over time.

Diversification: By

diversifying your passive income sources, you can create a robust financial

portfolio that mitigates the risk of relying solely on one income stream.

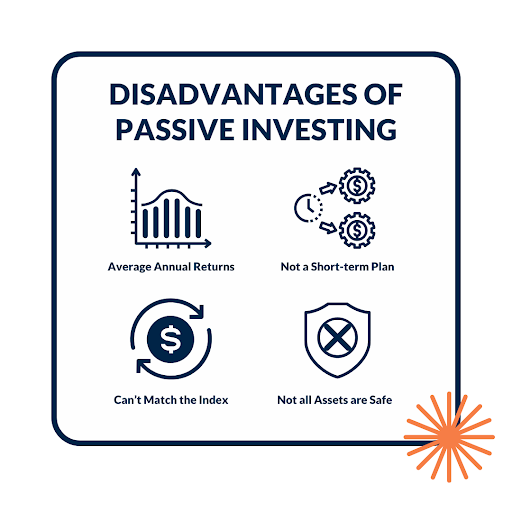

Potential drawbacks of passive income:

Initial effort: Setting up passive income streams often requires upfront work and investment, such as researching and selecting the right investment options or establishing a business.

Lack of control: While

passive income can provide financial stability, external factors may still

impact your earnings, such as market fluctuations or changes in consumer

demand.

Limited growth potential:

Some passive income streams may have a cap on income potential, especially in

cases where you rely on external factors like market trends.

Active Income: Trading Time for Money

What is active income?

Active income is earned through your direct involvement in an activity or job.

This type of income relies on exchanging your

time, skills, or services for compensation. Unlike passive income,

active income typically stops when you stop working.

Examples of active income

Salary

or wages: Earning a fixed amount for the work you do on a

regular basis in a traditional employment setup.

Outsourcing:

Offering administrations as an essayist, visual creator, specialist, or

whatever other calling where you are paid for your skill and exertion.

Commission-based positions:

Deals experts, realtors, and protection facilitates frequently acquire pay in

view of the quantity of deals they make.

Business: Beginning and

maintaining your own business, whether it's an actual store, an internet based

adventure, or a consultancy, can produce dynamic pay.

Advantages of active income:

Immediate earnings:

Unlike passive income, active income offers instant gratification as you

receive compensation for your work right away.

Control over income potential: With active income, you have the power to increase your

earnings by putting in more time and effort.

Skill development:

Active income can provide opportunities to enhance your expertise and gain

valuable experience in your chosen domain.

Potential drawbacks of active income:

Time-bound:

Active income streams rely on your continuous involvement, limiting your

ability to pursue other interests or enjoy true financial independence.

Vulnerability to job market fluctuations: Active income can be affected by factors outside of your

control, such as economic downturns or industry changes.

Restricted adaptability:

Dynamic pay is frequently attached to the quantity of hours worked or the limit

of your business, making it trying to altogether scale your profit.

Conclusion:

Gauging the Upsides and downsides In the fight between recurring, automated revenue versus dynamic pay, there is nobody size-fits-all response. The decision eventually relies upon your monetary objectives, way of life inclinations, and chance resistance. Passive income offers the allure of earning money while you sleep, providing flexibility and scalability. On the other hand, active income provides immediate earnings and the potential for unlimited growth through continuous effort. To achieve a well-rounded financial strategy, it may be wise to diversify your income streams, combining both passive and active sources. By leveraging the advantages of each, you can create a robust and resilient financial future. So, which income stream appeals to you? Is it safe to say that you are prepared to investigate the universe of automated revenue, effectively seek after dynamic pay, or maybe a mix of both? The decision is yours to make, as you set out on the excursion towards monetary flourishing!

0 Comments